What Does Eb5 Investment Immigration Do?

What Does Eb5 Investment Immigration Do?

Blog Article

The Best Guide To Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration Can Be Fun For Anyone4 Easy Facts About Eb5 Investment Immigration DescribedNot known Facts About Eb5 Investment ImmigrationThe Best Strategy To Use For Eb5 Investment ImmigrationGetting The Eb5 Investment Immigration To Work

Based on our newest clarification from USCIS in October 2023, this two-year sustainment duration starts at the factor when the funding is invested. Nevertheless, the duration can be longer than two years for a couple of reasons. The most current update from USCIS does not clear up the time structure in which the funding is considered "spent." On the whole, the beginning of the period has actually been considered the factor when the money is deployed to the entity liable for task production.Find out more: Understanding the Return of Capital in the EB-5 Process Understanding the "in jeopardy" need is crucial for EB-5 investors. This principle emphasizes the program's intent to promote genuine economic task and work creation in the USA. The financial investment comes with inherent dangers, cautious task selection and compliance with USCIS guidelines can assist capitalists accomplish their objective: irreversible residency for the investor and their family and the ultimate return of their capital.

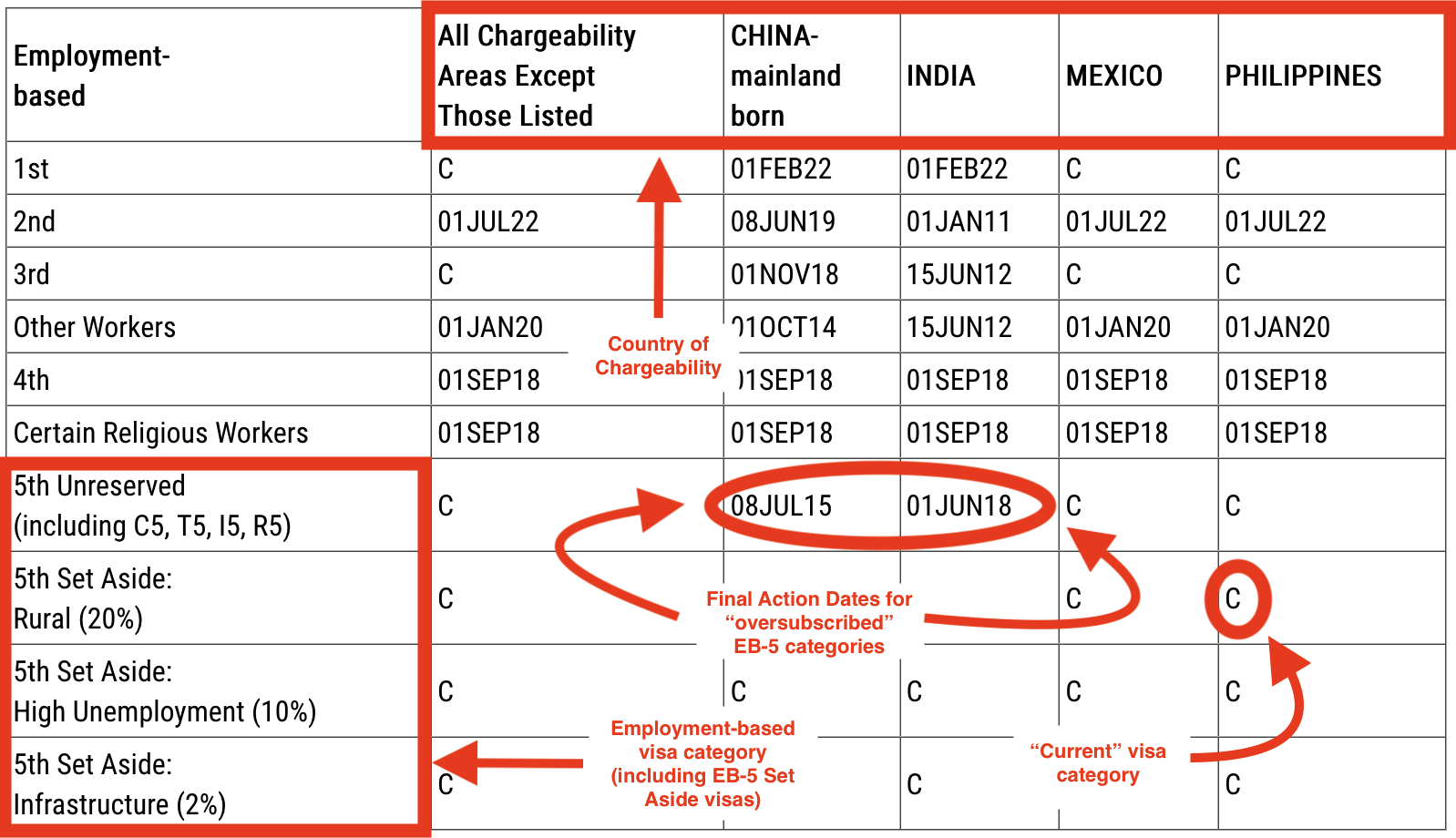

To come to be eligible for the visa, you are needed to make a minimum investment relying on your selected investment option. EB5 Investment Immigration. Two investment alternatives are available: A minimal straight financial investment of $1.05 million in an U.S. company outside of the TEA. A minimal financial investment of a minimum of $800,000 in a Targeted Employment Area (TEA), which is a country or high-unemployment location

The 6-Minute Rule for Eb5 Investment Immigration

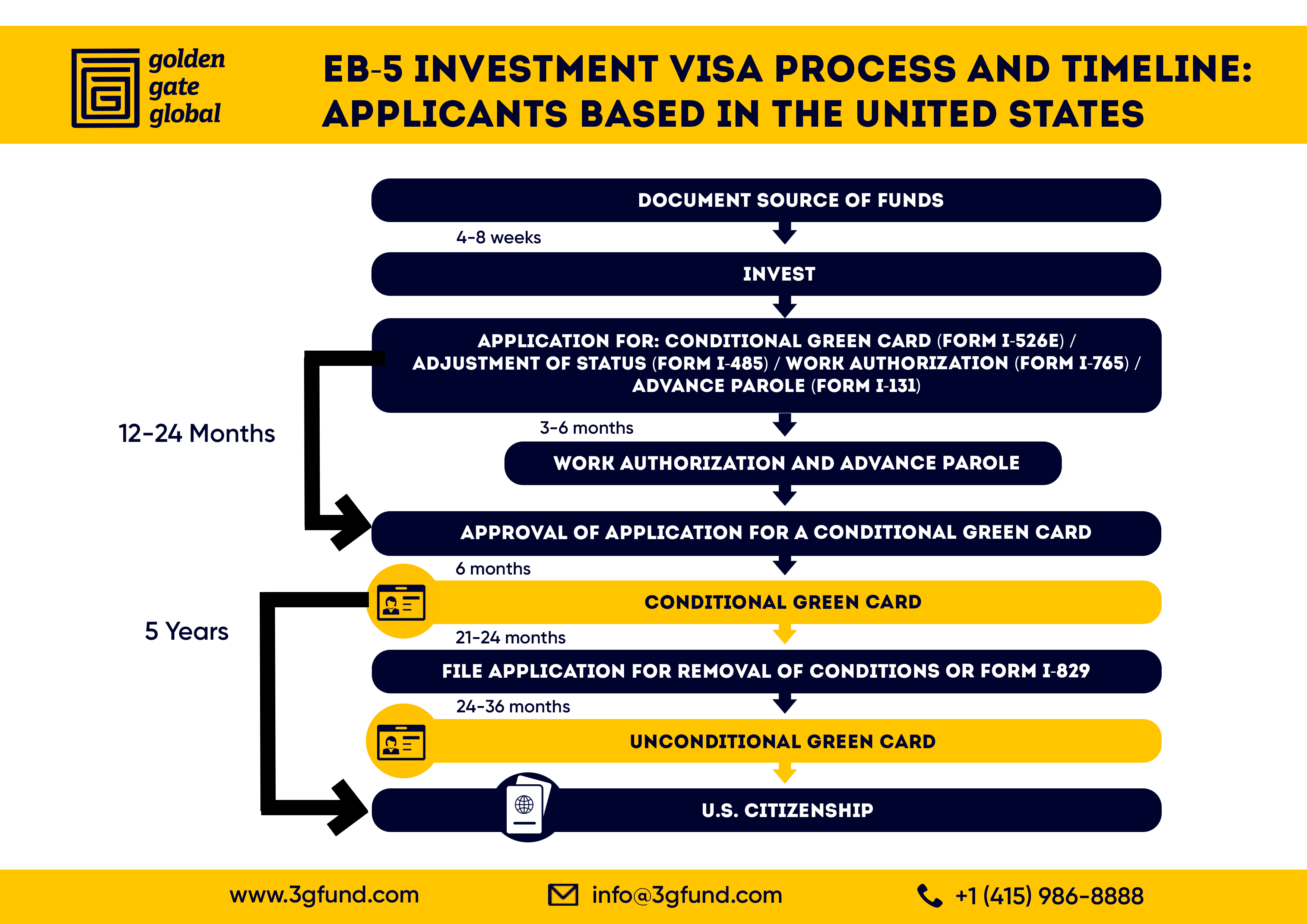

For consular processing, which is done via the National Visa Center, the immigrant visa handling charges payable each is $345. If the investor remains in the US in an authorized standing, such as an H-1B or F-1, he or she can submit the I-485 type with the USCIS- for readjusting condition from a non-immigrant to that of irreversible citizen.

Upon approval of your EB5 Visa, you obtain a conditional permanent residency for 2 years. You would certainly need to file a Type I-829 (Application by Financier to Get Rid Of Conditions on Permanent Homeowner Condition) within the last 3 months of the 2-year legitimacy to eliminate the conditions to come to be a permanent citizen.

As per the EB-5 Reform and Integrity Act of 2022, local center capitalists have to additionally send an additional $1, 000 USD as component of filing their petition. This added expense does not put on a modified request. If you picked the choice to make a direct investment, after that you 'd require to connect a business strategy together with your I-526.

Examine This Report about Eb5 Investment Immigration

In a direct financial investment, the investors structure the financial investment themselves so there's no additional administrative cost to be paid. There can be specialist fees borne by the financier to ensure conformity with the EB-5 program, such as lawful costs, organization strategy writing fees, economist fees, and third-party coverage costs amongst others.

The financier is likewise accountable for obtaining a company plan that conforms with the EB-5 Visa demands. This extra expense might vary from $2,500 to $10,000 USD, depending on the nature and structure of business. EB5 Investment Immigration. There can be extra costs, if it would certainly be sustained, for instance, by market study

An EB5 financier need to additionally consider tax obligation factors to consider for the duration of the EB-5 program: Because you'll become a permanent homeowner, you will certainly undergo revenue taxes on your around the world revenue. You need to report and pay taxes on any revenue obtained from your financial investment. If you offer your investment, you might go through a resources gains tax.

What Does Eb5 Investment Immigration Do?

If you're planning to purchase a local center, you can search for ones that have low costs yet still a high success price. This makes sure that you spend less cash while still having a high possibility of success. While hiring an attorney can include in the costs, they can assist minimize the overall prices you have to pay over time as legal representatives can make sure that your application is complete and exact, which minimizes the possibilities ofcostly errors or hold-ups.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

The locations beyond urbane statistical locations that qualify as TEAs in Maryland are: Caroline County, Dorchester Region, Garrett Region, Kent Region index and Talbot Area. The Maryland Department of Commerce is the designated authority to accredit locations that certify as high joblessness areas in Maryland according to 204.6(i). Commerce accredits geographic locations such as counties, Census marked locations or demographics tracts in non-rural areas as locations of high joblessness if they have unemployment prices of at the very least 150 percent of the nationwide unemployment price.

We assess application demands to license TEAs under the his response EB-5 Immigrant Financier Visa program. EB5 Investment Immigration. Demands will certainly be examined on a case-by-case basis and letters will certainly be issued for locations that satisfy the TEA demands. Please review the steps listed below to establish if your suggested task remains in a TEA and follow the directions for requesting a qualification letter

Report this page